Calculate book value of equipment

5 Accredited Valuation Methods and PDF Report. Fill in the items residual value.

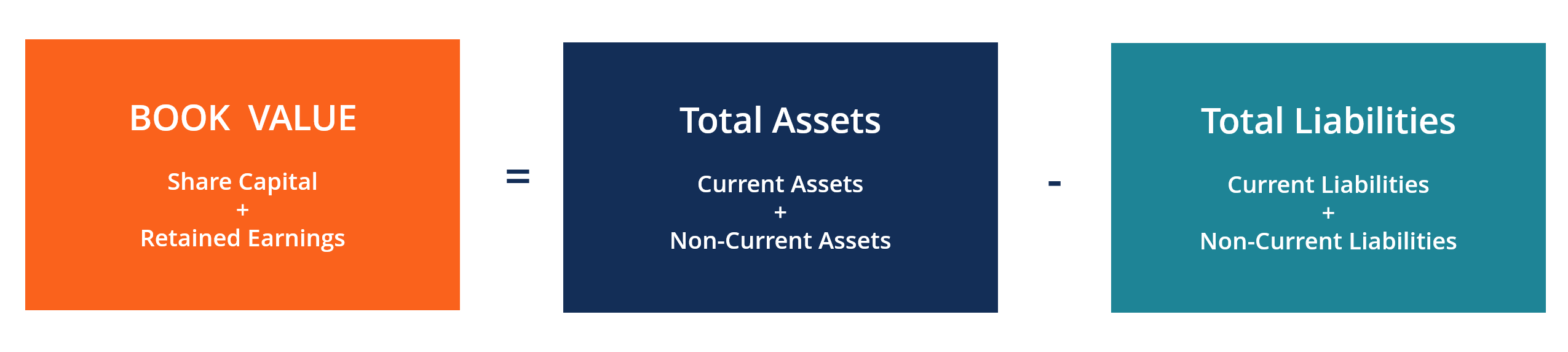

Book Value Formula How To Calculate Book Value Of A Company

Well show you the average lowest.

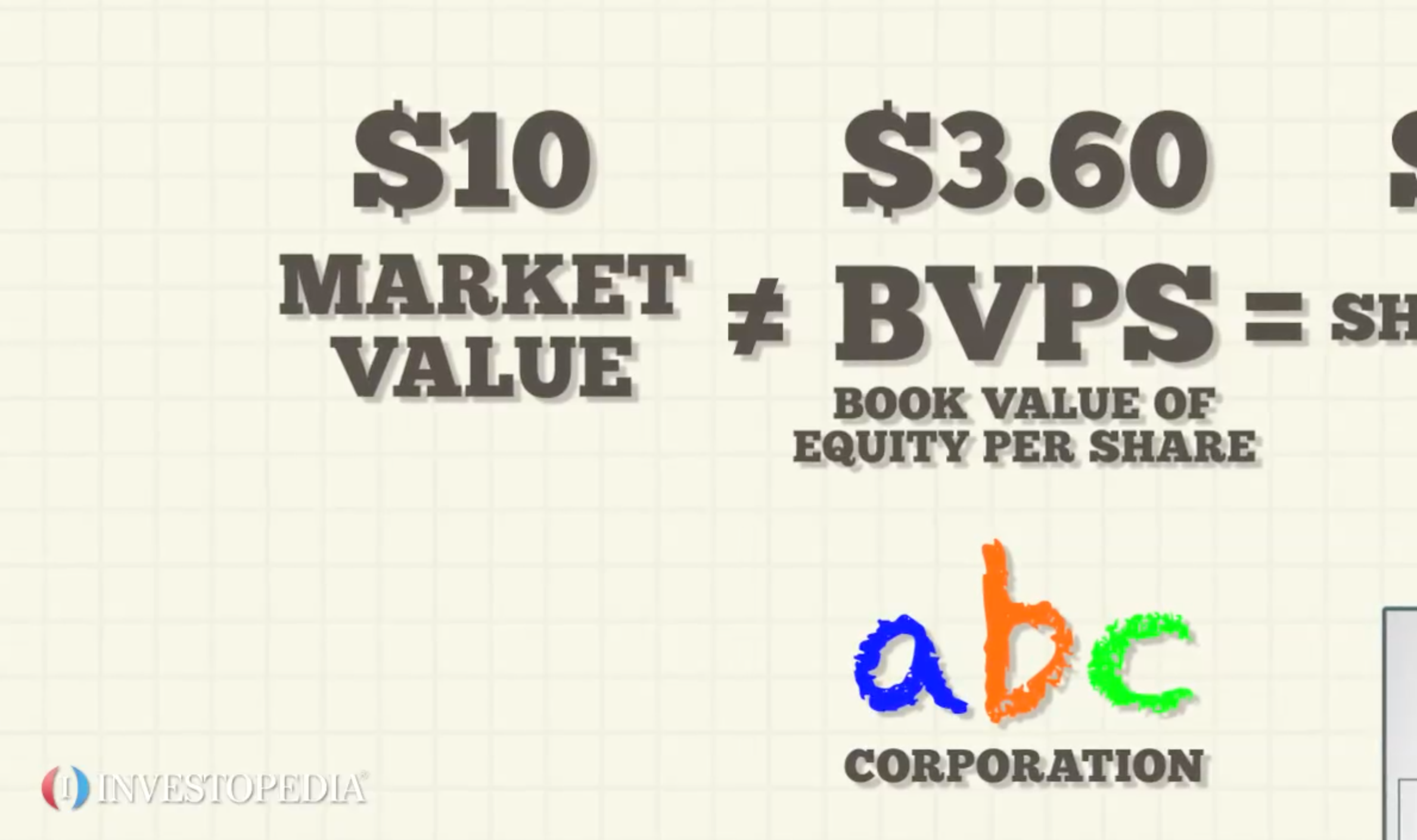

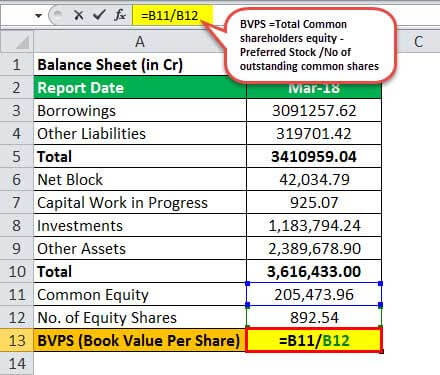

. An assets original cost goes beyond the ticket price of the. Book Value per share Book Value of Equity Total Shares Outstanding. Its a quick way to find out the range of listed prices for your search.

If you want to calculate book value use this formula. The book value or cost of the asset less its accumulated depreciation must be removed from the accounting records. 5 Accredited Valuation Methods and PDF Report.

Book Value per share Rs 30 per share. The first equation deducts accumulated depreciation from the total assets to get the book value amount. If the asset is disposed of for more than its book value the seller records.

Click Items next click on one item. Book value is an accounting measure of the net value of a company. Fill in the items purchase price and its purchase date.

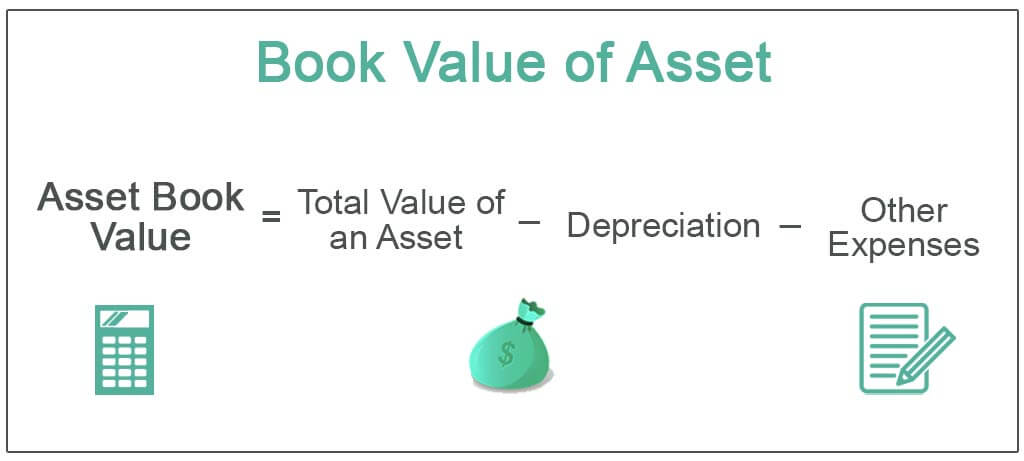

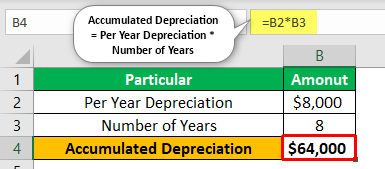

The items Book value will automatically be. Book value cost value annual depreciation x age For example if five years ago you purchased construction. No Financial Knowledge Required.

The appraiser will view your machine and calculate its value based on. We advise setting up the current book. For instance a widget-making machine is said to depreciate.

Check prices for your favorite vehicles. Check prices by MAKE MODEL AND YEAR. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

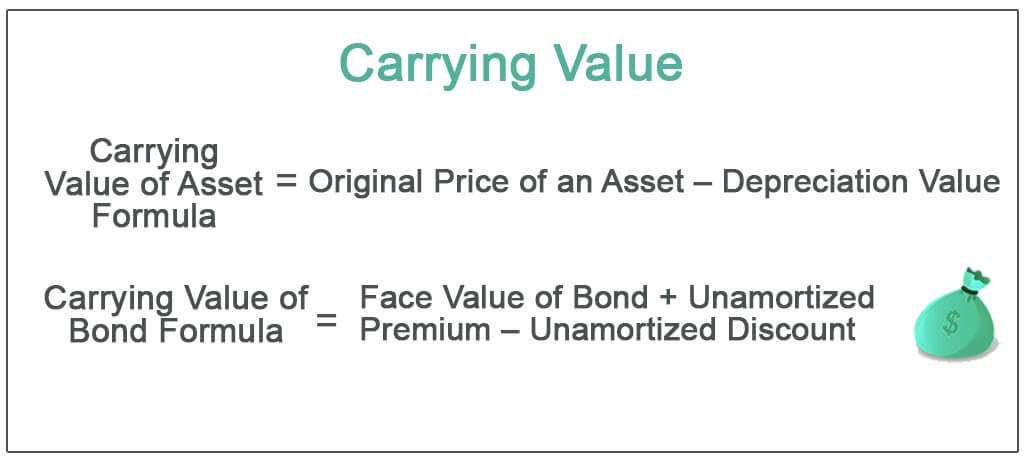

Book value also called carrying value or net book value is an assets original cost minus its depreciation. Equity is the total value of all shares issued. You can calculate the value of your equipment stock by exporting your equipment and making the calculations in Excel or Google Sheets.

The formula for calculating NBV is as follows. Inform the appraiser that you want to know the items book value on the day of the appointment. Ad Reliable Valuation -Based on Market Data- to Increase the Success of Your Deal.

It can be greater than less than or equal to zero. You can calculate the value of your equipment stock by exporting your equipment and making the calculations in Excel or Google Sheets. Book value is the companys total assets minus its liabilities and intangible assets.

There are various equations for calculating book value. Book value of an asset is the value at which the asset is carried on a balance sheet and calculated by taking the cost of an asset minus the accumulated depreciation. 22 hours agoPrimedeq India launches used medical equipment value calculator.

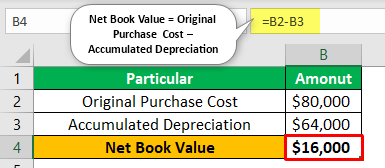

Here are five steps you can follow that may help you calculate a companys book value. How do you calculate book value of equipment. Net Book Value Original Asset Cost Accumulated Depreciation.

In order to calculate the book value of a company you may. Its a metric used to calculate the valuation of a company based on its assets and liabilities. Book Value per share 30 1.

Price to Book Value is calculated as. Ad Reliable Valuation -Based on Market Data- to Increase the Success of Your Deal. No Financial Knowledge Required.

Check prices for your favorite vehicles.

/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)

Book Value Vs Market Value What S The Difference

Book Value Definition Importance And The Issue Of Intangibles

Book Value Of Equity Formula And Calculator

Straight Line Depreciation Accountingcoach

Salvage Value Formula And Example Calculation Excel Template

Net Book Value Meaning Formula Calculate Net Book Value

Book Vs Market Value Key Differences Formula

Book Value Of Assets Definition Formula Calculation With Examples

Book Value Per Share Bvps Ratio Formula And Calculator

What Is Book Value Definition How To Calculate Faq Thestreet

What Is Book Value Definition How To Find It Use In Investing

Net Book Value Meaning Formula Calculate Net Book Value

Book Value Of Equity Formula And Calculator

Book Value Formula How To Calculate Book Value Of A Company

Carrying Value Definition Formula How To Calculate Carrying Value

Net Book Value Meaning Formula Calculate Net Book Value

Book Value Per Share Bvps Ratio Formula And Calculator